Yes, Dental Implants Are Tax Deductible When Medically Necessary

Dental implants tax deductible status depends on medical necessity and IRS requirements. Most dental implant procedures qualify as deductible medical expenses when they restore oral function, replace missing teeth due to injury or disease, or address significant dental health issues.

Free Consultation Available – Contact Us Today!

Understanding Dental Implant Tax Deductions

The Internal Revenue Service treats dental implants as qualified medical expenses under medical and dental expenses guidelines. Your dental implant tax deduction eligibility requires meeting specific criteria and exceeding the adjusted gross income threshold.

Key Requirements:

- Medical Necessity: Dental implants must address oral health problems, not cosmetic enhancement

- AGI Threshold: Total medical expenses must exceed 7.5% of your adjusted gross income AGI

- Documentation: Proper receipts and medical records proving necessity

- Out-of-Pocket Costs: Only expenses not covered by dental insurance qualify

Professional guidance ensures you maximize your potential tax savings while following tax laws correctly.

Our Tax Consultation Services

Individual Dental Expense Planning

We help individuals calculate deductible medical expense amounts and determine when dental implants qualify for tax benefits.

Business Owner Medical Deductions

Specialized advice for self-employed professionals managing significant medical expenses through Health Savings Account strategies and business deductions.

Types of Tax Deductible Dental Implant Procedures

- Traditional Dental Implants: Full tooth replacement for missing teeth from injury or disease

- Mini Dental Implants: Cost effective alternative for multiple tooth replacement

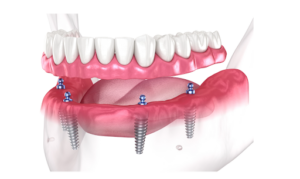

- All-on-4 Implants: Complete arch replacement addressing severe tooth decay

- Implant-Supported Dentures: Secure alternative to loose dentures

- Single Tooth Implants: Replace individual missing teeth affecting oral function

- Bone Grafting: Preparatory procedures for implant placement

- Sinus Lifts: Surgical procedures enabling upper jaw implants

- Abutments and Crowns: Components completing implant restoration

Each procedure type has specific documentation requirements for tax deduction purposes.

Tax Deduction Calculation Process

Step 1: Calculate Your AGI Threshold

Determine 7.5% of your adjusted gross income to establish your minimum deductible medical expense amount.

Step 2: Document All Dental Costs

We help organize receipts for dental implant costs, treatment costs, and expenses related to your dental implant procedure.

Step 3: Assess Insurance Impact

Calculate how dental insurance covers your expenses and identify out of pocket expenses eligible for deduction.

Step 4: Complete Form 1040 Schedule A

Professional preparation ensures accurate reporting of deductible medical expenses on your tax return.

Real Client Success Stories

“Their expertise saved me $4,400 in taxes on my dental implant treatment. The documentation process was seamless.”If you’re exploring dental implant options, learn more about the differences between same-day dental implants and traditional methods to help you choose the best solution for your needs. – Maria, Retired Teacher

“As a small business owner, they helped me understand how my dental implant expenses affected both personal and business tax benefits.”

– David, Contractor

Common Tax Deduction Scenarios

Scenario 1: Traditional Implants After Accident

Client Profile: $60,000 AGI, $8,000 dental implant expenses

AGI Threshold: $4,500 (7.5% of $60,000)

Deductible Amount: $3,500 in qualified medical expenses

Scenario 2: Multiple Implants

Client Profile: $75,000 AGI, $12,000 total dental costs

Insurance Coverage: $4,000

Out-of-Pocket: $8,000

Deductible Amount: $2,375 after meeting $5,625 threshold

Scenario 3: Full Mouth Reconstruction

Client Profile: $90,000 AGI, $55,000 dental implant treatment

Insurance Contribution: $16,000

Tax Benefit: Significant advantage with $22,250 in deductible expenses

Frequently Asked Questions

Are cosmetic dental implants tax deductible?

Cosmetic procedures generally don’t qualify unless they address medical reasons like replacing teeth lost to injury or treating oral health conditions.

How does dental insurance affect my deduction?

Only expenses not covered by your insurance company qualify. We calculate the exact amount of out-of-pocket costs eligible for deduction.

Can I deduct mini dental implants?

Yes, mini implants qualify when they replace missing teeth for medical reasons rather than purely cosmetic dentistry purposes.

What about financing interest on dental treatments?

Interest payments on dental procedure financing generally aren’t deductible as medical expenses, though certain exceptions may apply.

Do traditional implants provide better tax benefits than dentures?

Both artificial teeth options qualify equally when medically necessary. The deductible expense amount depends on total treatment costs and insurance coverage.

Professional Tax Planning Services

Annual Medical Expense Planning

Strategic timing of dental implant procedures to maximize tax deductions across multiple tax years.

Health Savings Account Optimization

Guidance on using HSA funds for dental implant expenses while preserving other tax benefits.

Documentation Management

Complete record-keeping services ensuring IRS rules compliance and audit protection.

Contact Our Tax Professionals

Schedule Your Free Consultation

Don’t miss potential tax savings on your dental implant investment. Our experienced team provides personalized guidance for your specific situation.

Phone or Text: (301) 424-2030

Email: rockvilledentalarts1@gmail.com

Online Consultation Available – Saving Money on Dental Care Starts Here!